Talking FEMA

Talking FEMA: Financial Impacts of Flooding

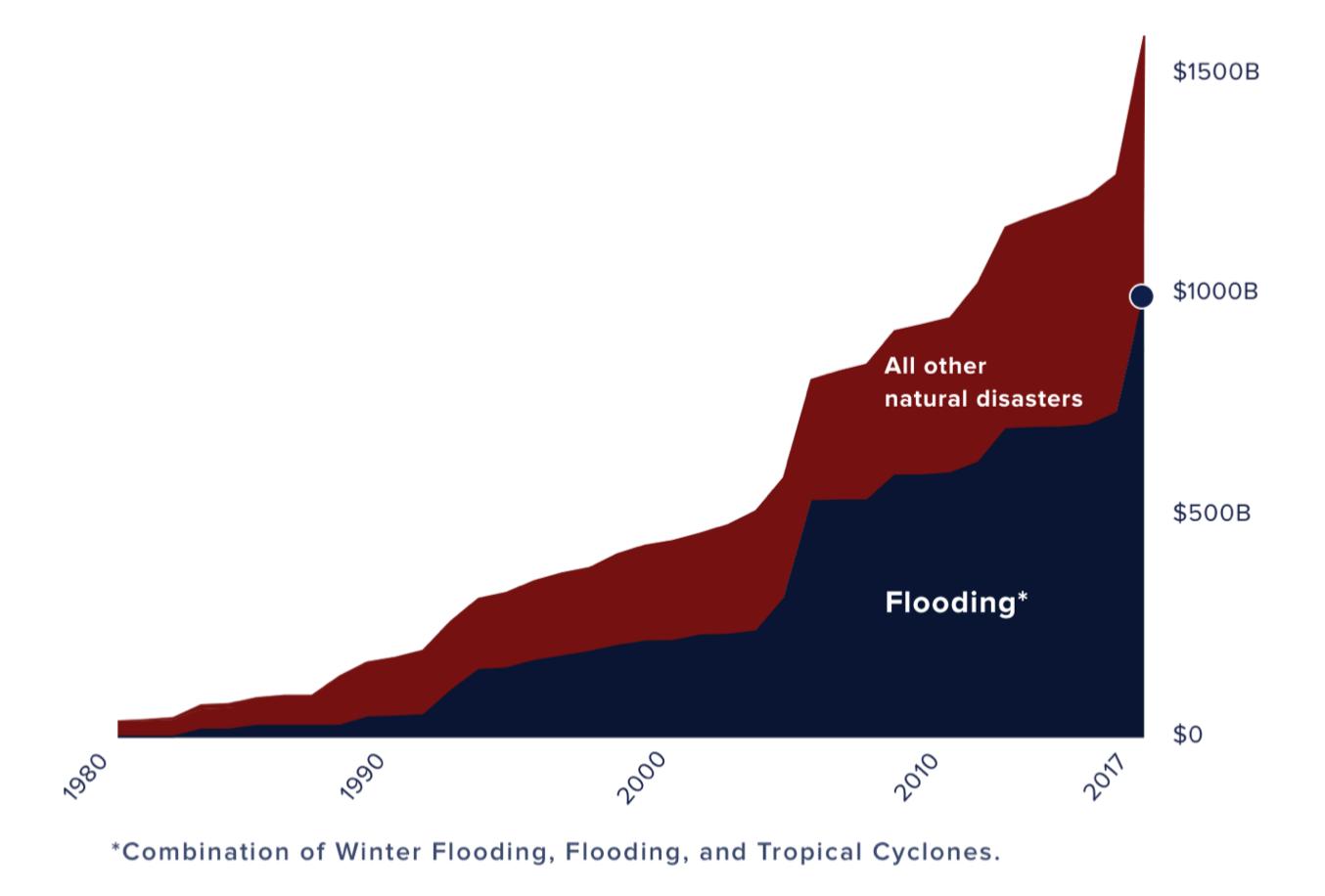

Summary: Data suggests that not only is natural disaster flooding costing more than any other natural disaster but the economic benefits to flood mitigation are enormously positive.

Flooding and Impacts:

Flooding has significant negative economic effects on communities. For example, the Federal Flood Insurance Program estimates that commuites are impacted by each major flood by a loss of 3.5% in employment. Communities generally have to increase the amount of debt they carry and this costs residents and taxpayers more. More floods mean more risk and higher community flood insurance as well.

In addition, flooding also has secondary impact, to such things tourism, family trauma, social disruption, business interruptions and shortage of critical human services. US tourism is 2.9% of the US GDP.

While most coastal real estate is not owned by those in extreme poverty, with the most impact going to middle income households, poor households are impacted more greatly because they generally are not insured and housing is of a poorer quality.

Financial Impacts of Mitigating Flooding;

According to a study in 2006 by the NFIP, benefits and gains associated with disaster recovery, such as construction and jobs do NOT offset flood mitigation. Flood mitigation far outweighs any disaster recovery benefits in the short and long term; According to the NFIP, mitigation not only causes less stress on residents but floodplain management elements reduce costs to government and municipalities.

Flood mitigation including physical mitigation make worthwhile to raise structures above the BFE and is estimated to provide almost $1B in savings annually or 71% savings of costs of not mitigating. This is probably a very simplified impact and secondary impacts are not fully accounted for, but clearly impacts to tourism in coastal tourism communities is enormous and job losses as well as long term trauma and social burdens indicate that flood mitigation is not only a social enhancement but clearly has a strong economic argument for mitigation. Imagine, in a place such as Panama City, Florida, which was impacted by Hurricane Maria, that your entire waterfront was wiped out. There was no water for almost a year, hotels and motels cannot take guests, restaurants are ruined, boats and debris scattered all over the water front for almost 2 years post flood. This is not a rich community, that has now lost a major income generator for two years.

Grants and Funding:

The Stafford Act provides federal assistance. Non residential real estate may also be eligible for SBA loans to cover losses. Tax deductions are potentially an important source of relief as well.

FEMA grants and assistance was valued at over $533M in 2022 so clearly there are multiple levels of federal programs to assist with flood mitigation elevation mitigation, engineering and technical assistance.

According to the graph above by First Street, flooding economic costs far exceed those costs by any other type of natural disaster in the United States.

Houston post hurricane—water no receding quickly creates health and safety as well as negative economic impacts.

Multi-family is Good for Lenders, Builders, and Investors — not just Office and Retail

As real estate advisors, we are often asked to prepare market analyses for client, especially to support financing and investment. As a general rule, it is often sub-market driven however, there are some major economic influences and factors that can affect major trends that are positive or negative to support investment in almost all markets. At this time, this is the case, national and even world trends, are making particular property types more favorable than others. Multi-family is very favorable at this time.

As of April 2022, CPI is at an annual rate 8% for the last 2 years, the highest since the 1970’s and interest rates are climbing as a result of the increased flow of money and increased demand. While higher interest rates make single family home purchase more expensive and drives down the prices of homes, it has the opposite effect on multifamily real estate.

Forbes March 8, 2022, article suggested there is an undersupply in multifamily units nationwide of over 8 million. While young families, new to the work force individuals and even Millennials, may find home purchasing out of their reach, they need a home to live in and rentals seem like the right choice until demand subsides and interest rates settle.

For the last 10 years the stock market was the place to invest, but with rising interest rates, the stock market is higher risk and less desirable than other forms of investment. Money is shifting to the multi-family market. Buying homes is becoming less affordable, interest rates only exacerbate that issue and population continues to grow, older inventory is undesirable, so new and recently built multifamily product is in great demand. To prove our point, since December 2021, multifamily REITs have generated returns of 46%. While we would not suggest office or retail REITs, multifamily is well positioned for the following reasons:

Excess demand and low inventory, national occupancy rates are over 96% and generally over 95% indicates high demand and time to build;

Lending rates increasing at 2% per year by the Feds makes home purchasing more expensive;

Increase in the overall population, which is growing at 3%, suggesting long term demand;

Historically multi-family has grown in demand during inflationary periods;

Increase in demand is followed by increase in rents while previously fixed debt interest on the property is possibly set for 20 or 30 years, therefore increase investor return;

Increasing income from rent allows builders to hedge against higher costs of materials and construction;

Lenders competing for deals will keep interest lower and more competitive

As a result, multifamily is a very good hedge against inflation, as a general property type. Of course, better managers, builder, more selective REITS are play a part in investment return.

American Rescue Plan of 2021

How Will the $2.25Trillion Infrastructure Stimulus Bill Affect the Future of TOD?

In March 2021, The Biden administration proposed a $2.25T infrastructure and stimulus bill. Within the total package, approximately $630Billion is targeted to transit, highways and affordable housing with $115 Billion towards bridge and road upgrades and $25B to airports.

The goal behind the massive bill is to unclog highway with dedicated bus lanes, queue jumps and faster public transit to encourage commuters off the road from their cars to public transportation. Within the $600B, 1/3 is dedicated to affordable housing which includes aging in place housing near transit and affordable housing to create racial equity near public transit. It is expected that with these funds, affordable housing monies will create housing that is less expensive, has easy access to transit and reduces road and highway congestion.

In addition to the $600B earmarked for transit and affordable housing, $5B has been allotted to brownfields. This will help free up dirty sites, many of which are urban, to real estate development, including affordable housing. The current government looks at TOD as urban, and as such, preserves bio-diversity by shifting new development from the countryside to the urban areas and preserves natural resources.

So, the next question is how much TOD could possibly be supported by this bill? For example, a 250-unit affordable mixed multi-family residential TOD complex with associated commercial space, say 50K sf of commercial, including retail or office, would cost $75M to $100M depending on the location. There is a possibility that the American Rescue plan could support up to 30 to 40 new major TOD projects which is almost one per state. Obviously the east and dense west coast states, such as CA, NY, CT, MA and PA would probably benefit the most.

Conclusion: With double the usual transit money allocated in the bill, it is good news for future TOD development.

The Williams Group Real Estate Advisors has been on the leading edge of TOD advisory services for over 15 years and has substantial experience teaming with brownfield redevelopment in New York and MA, so let’s work together!

TOD Development and Flight to the Suburbs

The new Biden administration has vowed to spend over $640 Billion over the next 10 years on housing. The focus is primarily on affordable housing and density in the suburbs.

The new Biden administration has vowed to spend over $640 Billion over the next 10 years on housing. The focus is primarily on affordable housing and density in the suburbs.

Putting politics aside, there may be a way to handle the outcome in an effective way that not only buffers the burbs from inappropriate high density housing but actually supports transit oriented development in appreciate locations..

The key to the issues is how to implement the density and affordability components in an appropriate planning way that supports transit, buffers established neighborhoods and creates economic development.

In addition to the $640M pledged toward affordable housing, $20 Billion is pledged to transit agencies to upgrade and connectivity improvements.

So, what does this mean for TOD, especially throughout the northeast? Overall, this could mean a windfall, with affordable housing less than 10% in many northeast communities, especially surrounding New York City, and south of Boston, this could mean the enhancement of development along transit corridors where dense housing, combined with origination and destination real estate makes a lot of sense.

For some cities where residents are typically origination residents or users, such as bedroom communities travelling to major urban centers, for example Stamford, CT to New York City, this could mean additional funding to further develop dense housing for people who want to live near transit and have an easy commute to their work destination. Already there is the development of dense housing around the local station, but more is in demand. In addition, there are multi-modal opportunities, such as ferry connections to lower Manhattan.

For destination locations, which could also mean Stamford, CT or White Plains, NY, this means funding to support improved transit, parking and mixed use office, retail/residential for people to originate somewhere on the transportation line and have a final destination as a transportation hub that could also be TOD. Instead of users getting on a bus or taxi, the office is abutting or near the transportation hub, they could just walk to work or home and pick up dinner or laundry, as part of the transit amenity system. Many locations, such as Stamford, Ct and White Plains, would be both destinations and points of origination. The point is, all along major transportation corridors, there is an opportunity to create origination sand destinations and dense mixed- use housing, of which a portion could most certainly be affordable and attractive to college graduates and young families, would make perfect planning sense, and at the same time would not dismantle the local municipal zoning but create appropriate commercial hubs and actually serve as a natural buffers between transit and neighborhoods.

It’s a win-win for all.

Malls “brace-brace”

For the time being, Globalization has taken a back seat, if not figuratively, but in actuality. Americans and the world are taking a seat and staying at home. What does that mean for real estate, and most specifically, logistics and distribution space?

“A Change is Gonna Come”

For the time being, Globalization has taken a back seat, if not figuratively, but in actuality. Americans and the world are taking a seat and staying at home. What does that mean for real estate, and most specifically, logistics and distribution space?

While there have been covid related factory shutdowns and a major product movement slowdowns early in the pandemic, after 8 months, the population has grown weary of the pandemic and the way they live and do business has shifted dramatically. E-commerce and associated product movement is now at an all time high.

Work at home, stay at home: Workers who are working at home are now indicating they would like to continue to work at least one day per week at home even post covid-19? What does this mean for products? More technology at home? Perhaps building or setting up a new in home office?

Retail and online shopping: Shopping online has taken a whole new and expanded landscape. E-commerce has seen a 129% increase over previous year in US and Canada. Almost 15% of all retail sales are now online, the biggest single year jump, according to Forbes. Total 2020 sales expected to be $710Billion in the US and $4.5T worldwide. Even after Covid-19 is under control, no forecaster is expecting any change in the e-commerce trends.

Movement of goods: Road, traffic and trucking increases dramatically. If you a have been out on any interstate in the last month, you can plainly see that truck traffic has increased dramatically. As the economy shifts to a more national economy, goods sourcing is more American, made in USA means moving goods within the country more and more.

3pl the future: More trucks on the road indicates demand for more warehousing and not just any kind of warehousing, but modern, technology driven picking and sorting distribution friendly space. 3PL, third party logistics, is expected to grow exponentially. This translates into warehousing and logistics, including shipping by a third party that services online retailers. Instead of a truck of saying “Walmart”, you will now see XPO logistics that may spilt a truck by customer so that a customer uses part of the truck and XPO makes this happen.

Price Consciousness Customers: Lock downs and higher unemployment, translate to more price conscious buyers. As a result, there will be more price-comparison online shopping and supply chain needs speed and efficiency in the suppler chain, including lower cost shipping, to meet this demand. As a result, logistic companies need to focus on high efficiency of route and resource optimization including significant automation.

Distribution Demand: CBRE says that for every $1Billion growth in e-commerce sales translates into an additional 1.25 Million SF of distribution demand. No market has seen demand growth like this before. In 2017, CBRE calculated that 30% of all industrial space demand was for e-commerce sales. This trend is only increasing.

Regional malls—“brace brace!”: Malls, especially large 1 Million or more SF regional and super regional malls are in for a precarious future. Can malls be converted to warehousing to meet logistics demands? Maybe yes, but there are challenges. The location needs to be just right, near an interstate of major product movement and near an exit. Space needs to meet height and space necessities. While department stores may be able to be converted to a high bay distribution warehouses, the inline stores present a major challenge and that may mean demolition and rebuilding, which may cost more than just starting from scratch.

Automation and Warehousing the Future: As the future of logistics is warehouse automation, it means self-driving trucks and a warehouse that can handle this kind of equipment, including wide rows, high bays, and rack picking. New warehousing/distribution space to meet e-commerce demands needs to be higher and larger than even 10 years ago. At least 32.3 ft of clear high is now needed and average building size has increased by 184,000 sf. Per JLL, 1.2Million SF of space is the most sought after in 2020.

So, to put it in terms we can comprehend, for every $1B in new ecommerce sales, we need a distribution center the size of a large regional mall, so good-by mall, hello distribution center.

Between 2019 and 2020, with the 129% jump in sales, demands equates approximately 200Million sf of right-sized distribution space for 2020 and beyond demands. Per JLL, in 2020 , 71 Million SF has already been leased to meet ecommerce distribution demands.

Most of the current inventory in the country is in Eastern and Central PA, over 1.4Billion SF. Most of this is along the I-78 corridor. This is great for PA, but sorry, not too many malls to convert on that corridor, that will all be new space to meet demand. This corridor has fabulous east/west access to the country right through the middle north/south axis. Chicago also meets this criteria with 1.2Billion SF of inventory. The North East is a smaller, but densely rich market to serve. The Boston market cannot meet its distribution space demands.

Conclusion: The 4Q 2020 conclusion is two-fold:

If you are a municipality with major N/S or E/W interstate access and control land near an exit, it is time to start marketing to 3PL and creating an on-line presence that advertises these assets. Distribution does not care about quality of life, or housing costs or good schools, it is all about moving the product and access to a small workforce that can manage the automation process.

The second finding is to all those regional malls that are succumbing to e-commerce. Once again, it is essential to be along a major logistics distribution corridor and the more department stores or big space on the pad, the better. With 1.2 Million SF being in the most demand, this may be a not-so sexy alternative for brick and mortar retail.